Capitalization table fundamentals

A capitalization table is a summary of equity ownership in a corporation. Good cap table maintenance and good corporate governance go hand in hand, so it is critical for corporations to keep their cap table accurate and up to date.

In its simplest form, a cap table is a spreadsheet that has columns for, at a minimum, stockholder name, number of shares of each equity type, and ownership percentage. This simple form, however, belies the complexities that the table expresses. Taking steps to maintain an accurate and current cap table requires a certain level of discipline on the part of the company.

In this article, we provide tips for implementing some best practices that aim to ensure good cap table hygiene.

Getting started

A corporation should create a cap table as soon as it issues stock for the first time. It is easier to create a cap table on formation, when the number of stockholders is usually small and when all the documentation for the stock issuance is readily available and accessible. The cap table should be clean and precise, with just enough detail to be useful. Typically, the table includes the following with respect to each stockholder, warrant holder and optionholder:

- First and last name

- The number of shares owned (or shares under a warrant or option)

- The class and if applicable, series of stock, owned

- The ownership percentage, as a function of issued and outstanding stock (see our article on the authorized, issued and outstanding stock)

- The ownership percentage, as a function of the fully diluted capitalization (see below for a discussion of fully diluted capitalization)

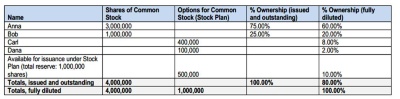

Here's a quick example. Imagine our company has four employees: Anna (the CEO), Bob (the CTO), and Carl and Dana, who are more recent hires. The company has authorized 10 million shares of common stock, and the company's board and stockholders approved an equity incentive plan (the stock plan) with 1 million shares reserved for issuance under the Stock Plan. Anna and Bob hold 3 million and 1 million shares of common stock, respectively; Carl and Dana have been granted options for 400,000 and 100,000 shares of common stock under the Stock Plan, respectively.

The cap table for this equity ownership would look as follows (click to view):

Note that we include separate columns for outstanding shares of common stock and options. This is because the founders' stock and the options are distinct equity interests with different legal rights. Similarly, the cap table should distinguish between equity granted outside a stock plan (ie, the founders' common stock) and inside a stock plan (ie, the options and the common stock resulting from any option exercises). Therefore, if 25 percent of Carl's options vest and he exercises, it would be customary for the table to include a new column titled "Shares of Common Stock (Stock Plan)" to list the 100,000 issued and outstanding shares from Carl's option exercise.

Also, note that we include the 500,000 shares available for issuance under the stock plan in the denominator to calculate our company's fully diluted ownership percentages. This is a typical definition of "fully diluted ownership" and is used to show what ownership percentages if all shares reserved under the stock plan were issued and all issued options were exercised.

Keeping your records current and accurate

Your cap table should only include equity issuances that have been properly issued and documented by the requisite parties (for more on the requirements for equity issuances, see our article). In general, before an item should be entered into a cap table, there should be a signed document evidencing board approval of the equity grant and a fully executed stock purchase agreement or notice of option grant, as applicable. Other transactions, like stock transfers, recapitalizations, or more complex equity issuances, may require additional documentation.

In contrast, if you enter an item into your cap table before the transaction has been duly executed, you have created a pro forma, not a cap table.

Completing the cap table

Options

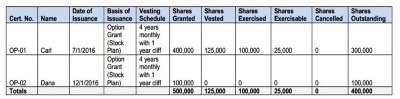

A simple treatment of options is shown in the sample cap table above, and when your company has just a few option holders, this approach is fine. But as your company grows, tracking the vesting schedules becomes more complex. The cap table should include an option ledger that records additional information, such as grant date, exercise price, vesting schedule, and the number of shares granted, vested, exercised, exercisable, cancelled and outstanding.

Below is a sample option ledger, assuming that 125,000 of Carl's 400,000 options have vested, of which he has exercised 100,000 options, and that none of Dana's options have yet vested (click to view):

Transfers, repurchases and other transactions

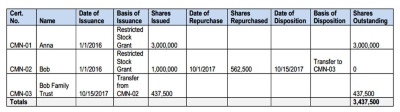

The cap table should also reflect transactions that result in changes of the holder of record or the number of shares, or that otherwise disposes of the stock originally issued. If one stockholder transfers stock to another stockholder, the disposition of stock is recorded in the company's stock ledger as a separate transaction.

Suppose that in our example company, Bob's 1 million shares were granted subject to the company's right to repurchase unvested shares on Bob's termination. Now, Bob leaves the company after 437,500 of his shares have vested, and the company repurchases the remaining 562,500 shares. Then, Bob transfers his shares to his family trust (assuming that such a transfer is permitted). A sample common stock ledger is shown below (click to view):

Preferred stock; voting rights; convertible instruments

Though preferred stock issuances are generally documented like common stock issuances, there is one key distinction: preferred stock is typically convertible into common stock and that the result of that conversion should be reflected in the cap table. The conversion ratio is often initially 1 to 1, but if the conversion ratio changes (based on circumstances that are specified in the company's charter), the cap table should include the number of shares of common stock would be issued on the preferred stock's conversion. This is often accomplished with a separate column titled "Common Stock Equivalent," which shows the equivalent number of shares of common stock for each entry on the cap table.

Voting rights are often adequately represented by the "% Ownership" columns. However, if the company's certificate of incorporation provides that a class of stock receives "super-voting" rights of more than one vote per share, or if a class is non-voting, then a "Voting Percentage" column should be used to display the actual percentages of the total voting power held by each equity holder in the cap table. Additionally, if certain corporate actions require the approval of a discrete class or series of the company's stock, voting as a separate class, then it is useful to maintain a record of the percentage of the voting power of such separate class or series held by each equity holder in the cap table.

Instruments that grant rights to the company's equity at a future date, such as convertible promissory notes or Y Combinator's increasing popular "SAFE," also should be listed in the cap table, as they will impact a company's capitalization. Although the exact number of shares into which these instruments may convert is often unknown until the trigger event (such as a qualified financing), these instruments should nonetheless be included and reflect the following to the extent applicable:

- the principal amount

- interest accrued

- maturity date

- valuation cap (see our article on conversion caps)

- conversion discount

Conclusion

Though maintaining an accurate cap table takes some patience and discipline, the payoff is a document that can be referenced by the company, or by potential investors, to immediately understand who owns the company and who controls the vote on important corporate matters.

Download PDF