Down rounds 101

By Charles TorresIntroduction

When a private company offers additional shares for sale at a lower price than the price sold in the previous financing round, that offering is known as a “down round.” Stated differently, a fundraising round is said to be a “down round” when the company’s pre-money valuation in the round is lower than the post-money valuation of the previous round.

Consequences of Having a Down Round

Private companies raise capital through rounds of funding, with the usual expectation being that, as the value of the company grows, the stock sold in each round will be issued at progressively higher prices to reflect the company’s growth. However, adverse market developments, failures to meet technical benchmarks, and other business challenges may result in deflated outlook, which in turn may induce later investors to insist on a lower price per share.

Down rounds are generally viewed by the market as a negative signal that the company has poor prospects and may have previously been overvalued. This perception may damage trust and confidence in the company’s prospects, dampen employee morale, and hinder future investment. For these reasons, you should (1) carefully consider alternatives to a down round, and (2) take certain precautionary measures. See the “Alternatives to a Down Round” and “Recommendations for Raising a Down Round” subsections below.

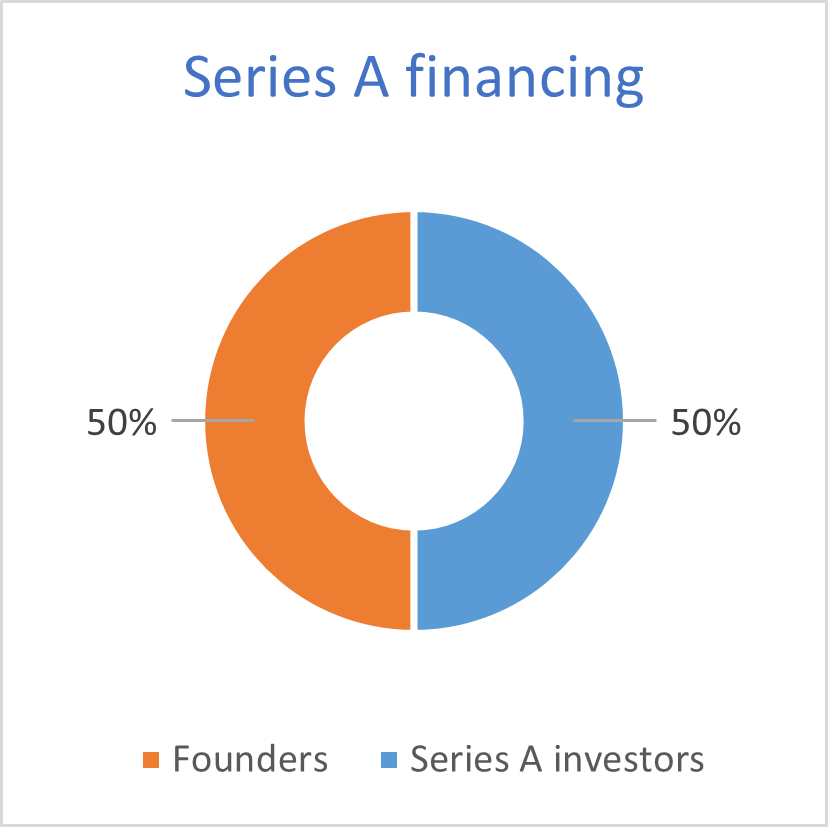

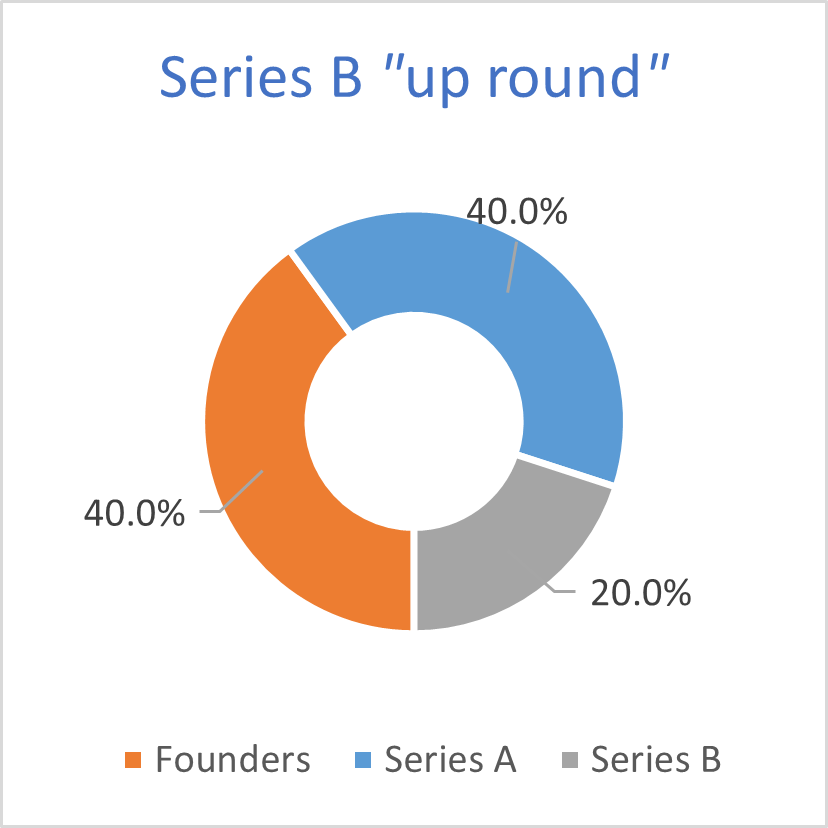

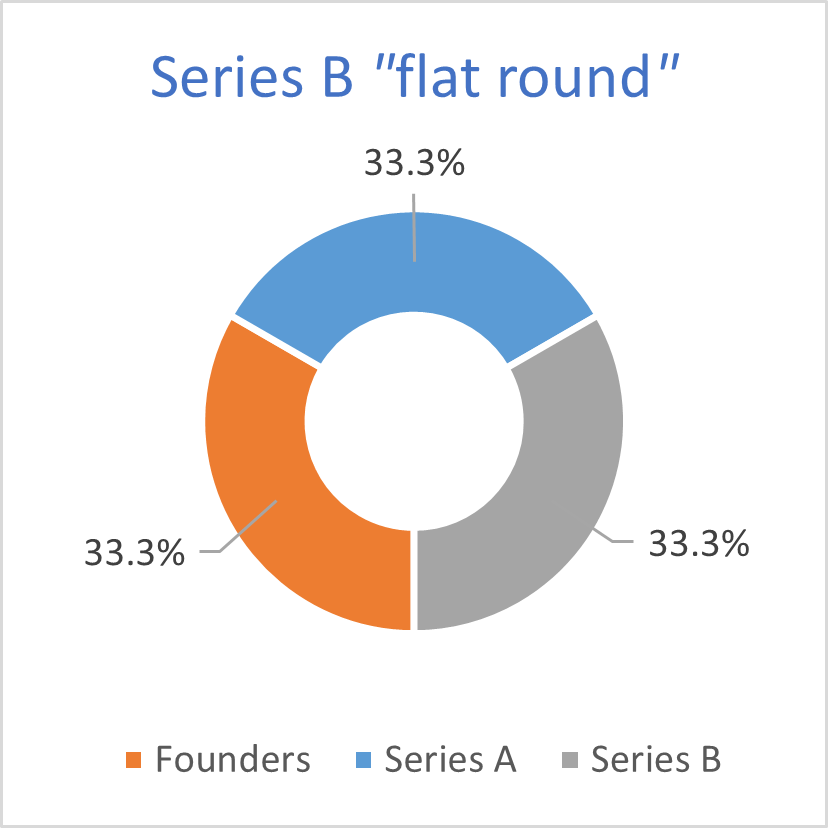

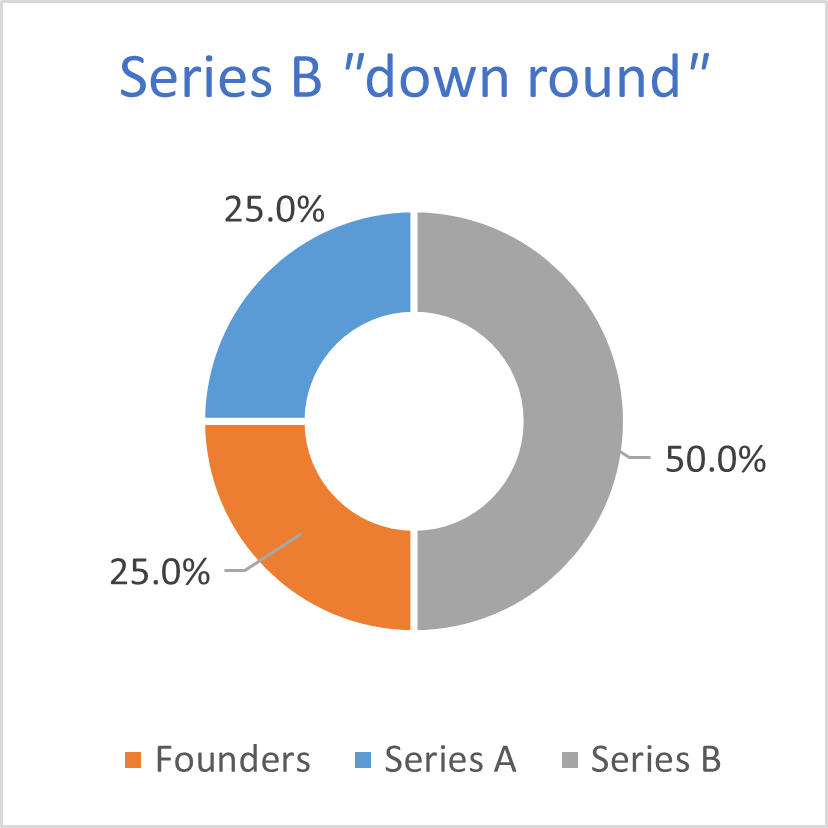

As is the case with all additional rounds of financing, a down round will dilute the existing investors’ ownership percentages. However, as illustrated in Figures 1 through 4 below, the dilutive effect of a down round is greater than an “up round” or a “flat round” due to the lower share prices and the correspondingly greater number of shares being issued. In addition, any anti-dilution protections in the company’s current preferred stock can magnify the dilution of founders’ common stock, which typically lacks such protections.

Figure 1 shows the state of a hypothetical company after its Series A financing.

|

ABC, Inc. as of immediately after closing of Series A financing (share numbers in thousands) |

|

|

Total number of shares outstanding: |

10,000 |

|

Founders’ shares (common stock) |

5,000 |

|

Series A investors’ shares (Series A preferred stock) |

5,000 |

|

Founders’ ownership % |

50% |

|

Series A investors’ ownership % |

50% |

|

Valuation of the company |

$10,000,000 |

|

Value of each share |

$1.00 |

Figure 2 illustrates a $5,000,000 Series B “up round”, with some dilution to the existing holders of Series A and common stock.

|

Series B financing (up round) (share numbers in thousands) |

|||

|

Pre-money |

Post-money |

||

|

Total shares |

10,000 |

Total shares |

12,500 |

|

Founders’ shares (common stock) |

5,000 |

Founders’ shares (common stock) |

5,000 |

|

Series A investors’ shares (Series A preferred stock) |

5,000 |

Series A investors’ shares (Series A preferred stock) |

5,000 |

|

Founders’ ownership % |

50% |

Series B investors’ shares (Series B preferred stock) |

2,500 |

|

Series A investors’ ownership % |

50% |

Amount of Series B investment |

$5,000,000 |

|

Pre-money valuation |

$20,000,000 |

Post-money valuation |

$25,000,000 |

|

Value of each share |

$2.00 |

Value of each share: |

$2.00 |

|

|

|

Founders’ ownership % |

40.0% |

|

|

|

Series A investors’ ownership % |

40.0% |

|

|

|

Series B investors’ ownership % |

20.0% |

Figure 3 illustrates a $5,000,000 Series B “flat round”, with greater dilution to the existing stockholders.

|

Series B financing (flat round) (share numbers in thousands) |

|||

|

Pre-money |

Post-money |

||

|

Total shares |

10,000 |

Total shares |

15,000 |

|

Founders’ shares (common stock) |

5,000 |

Founders’ shares (common stock) |

5,000 |

|

Series A investors’ shares (Series A preferred stock) |

5,000 |

Series A investors’ shares (Series A preferred stock) |

5,000 |

|

Founders’ ownership % |

50% |

Series B investors’ shares (Series B preferred stock) |

5,000 |

|

Series A investors’ ownership % |

50% |

Amount of Series B investment |

$5,000,000 |

|

Pre-money valuation |

$10,000,000 |

Post-money valuation |

$15,000,000 |

|

Value of each share |

$1.00 |

Value of each share: |

$1.00 |

|

|

|

Founders’ ownership % |

33.3% |

|

|

|

Series A investors’ ownership % |

33.3% |

|

|

|

Series B investors’ ownership % |

33.3% |

Finally, Figure 4 illustrates a $5,000,000 Series B “down round”, with the greatest dilutive impact on the current stockholders.

|

Series B financing (down round) (share numbers in thousands) |

|||

|

Pre-money |

Post-money |

||

|

Total shares |

10,000 |

Total shares |

20,000 |

|

Founders’ shares (common stock) |

5,000 |

Founders’ shares (common stock) |

5,000 |

|

Series A investors’ shares (Series A preferred stock) |

5,000 |

Series A investors’ shares (Series A preferred stock) |

5,000 |

|

Founders’ ownership % |

50% |

Series B investors’ shares (Series B preferred stock) |

10,000 |

|

Series A investors’ ownership % |

50% |

Amount of Series B investment |

$5,000,000 |

|

Pre-money valuation |

$5,000,000 |

Post-money valuation |

$10,000,000 |

|

Value of each share |

$0.50 |

Value of each share: |

$0.50 |

|

|

|

Founders’ ownership % |

25.0% |

|

|

|

Series A investors’ ownership % |

25.0% |

|

|

|

Series B investors’ ownership % |

50.0% |

Because investing in a down round is viewed as being inherently riskier, investors in down rounds may insist on additional favorable terms such as (1) “full-ratchet” anti-dilution protections (see the Accelerate post “What is anti-dilution and why does it matter to me as a company founder.”), (2) more favorable liquidation preferences (greater than the typical 1x multiple), or (3) requiring existing preferred stockholders to convert to common so as to make the future realization of a liquidation preference more likely for the new investors. The founders should carefully consider the ramifications of these terms with their counsel.

Alternatives to a Down Round

Before raising a down round and in light of the harshly negative consequences discussed above, it is imperative that the company’s directors, lawyers, bankers, and other advisors carefully consider alternative strategies. These actions include:

- Conducting thorough, ongoing market checks to determine whether a down round financing is the best option reasonably attainable in the marketplace. If financial resources permit, the company should consider engaging an investment banking firm or other advisory institution to assist in conducting market checks, assessing the competitive landscape, and exploring strategic alternatives. The company should consider other methods of fundraising, including issuing convertible notes (which may be appropriate if the cash flow issue is temporary) or outright sales of the company. Market checks and any related diligence should be carefully documented in the board minutes and other documentation.

- Reducing the company’s burn rate by cutting costs wherever possible. This is the most obvious solution but may not always be feasible due to commercial realities and limitations.

- Issuing a flat round (i.e., a financing round in which the pre-money valuation is the same as the post-money valuation of the previous round) by enticing investors with more favorable terms other than price per share – for instance, a preferred liquidation preference higher than 1x, issuing “participating” preferred stock, and/or offering stock with accruing dividends. Founders should, of course, carefully consider the implications of these with counsel.

- Founders may attempt to renegotiate the existing investors’ anti-dilution adjustments so as to mitigate the dilutive impact of the down round. The existing investors may, for instance, agree to waive their anti-dilution adjustments in exchange for other investor protections, such as pro rata rights (i.e., the right, but not the obligation, to purchase a pro rata portion of future stock issuances).

Recommendations for Raising a Down Round

After considering alternatives, if the company still decides to proceed with a down round financing, it should take certain steps to avoid exposing the deal to excessive legal risks.

- Form a committee of independent and disinterested directors to evaluate and approve the down round financing. Ideally, this committee should also include representatives of the diluted stockholder classes.

- Try to get a disinterested new investor (as opposed to an existing stockholder) to lead and price the round. A company engaging in a down round led by existing investors and insiders may appear to lack the objectivity of a new investor leading the round.

- With input and assistance of counsel, draft an information statement addressed to its stockholders:

- Explaining that all options for raising capital have been considered and a down round has been determined to be appropriate on an exhaustive review of the circumstances;

- Describing quantitatively the antidilutive effects of issuing a down round and fully disclosing the negative impacts to the current investors;

- Offering all existing accredited investors the right to participate pro rata; and

- Soliciting stockholder approval of the financing.

- If attainable, the company should obtain the written approval of the disinterested directors, at least a majority of the stockholders, and a majority of the diluted stockholder classes. However, note that this may backfire if the diluted classes reject the deal, which would leave on the record a negative fact that cannot be taken back.

- In connection with the board’s evaluation, consider the possibility of obtaining an independent third-party valuation. However, this may be cost-prohibitive and may be perceived as being self-serving.

- In support of a claim that the deal was bargained in good faith at arms-length, the company can seek additional pro-company terms in conjunction with the offering, such as lowering liquidation preferences, eliminating any participating preferred features, adding pay-to-play provisions, watering down protective veto provisions, increasing its employee pool on a post-money basis, or otherwise improving upon the terms in its last round of financing.

- Carefully and diligently document the financing and approval process. Board minutes should contain a clear record of the market checks, outside financial advice, evaluation of strategic alternatives, approval of special committees, efforts to protect the diluted stockholders, and other steps taken in the process of completing the financing.

Conclusion

Although down rounds are undesirable and present many business and legal challenges, certain actions may alleviate the negative consequences. Down rounds can be psychologically damaging, so it is vital that all viable alternatives are considered and necessary steps taken to minimize liability exposure.

Download PDF