When to WARN: Worker Adjustment and Retraining Notification Act

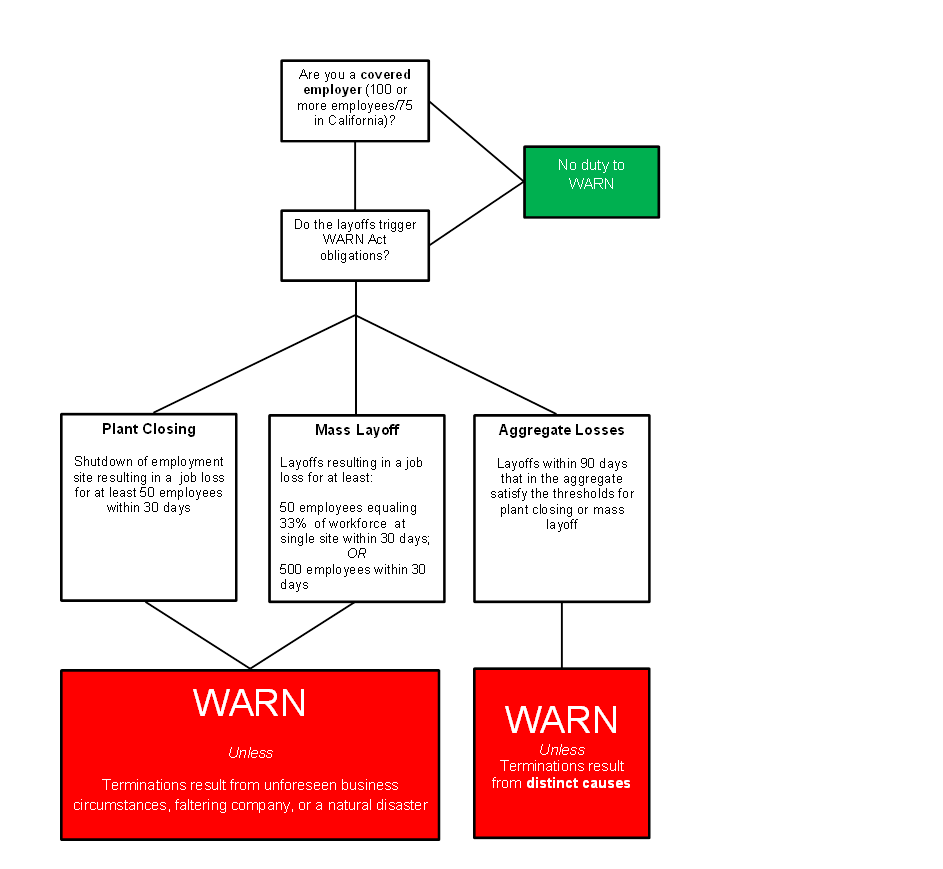

Employers must exercise caution when laying off employees, to ensure that such terminations do not run afoul of federal, state or local labor and employment laws. This is particularly true in the case of mass layoffs, as the federal Worker Adjustment and Retraining Notification Act (WARN Act) imposes special obligations on employers laying off 50 or more employees or undergoing a plant closing. Employers who fail to comply with these requirements may face strict penalties. The discussion below provides some background on the WARN Act, including which employers are covered by the law, how the law is triggered, and what employers must do once it is triggered.[1]

Who is covered by WARN?

Employers are covered by the WARN Act (a Covered Employer) if, company-wide, they have:

- 100 or more full-time employees (employees who work 20 or more hours per week and have worked for the employer for six months or more) or

- 100 or more employees, including part-time employees, who work at least 4,000 hours per week, excluding overtime.

Employees are generally covered by the WARN Act if they are terminated or laid off for more than six months, or if they have their regular work hours reduced by more than 50 percent for at least six months. Part-time employees are also protected by WARN and must get WARN Notice even if they do not count towards the initial employer threshold.

When is WARN triggered?

Covered employers must provide WARN Notice upon a triggering event, which is measured by the number of affected employees at a single site, and not company-wide. The WARN Act is triggered by:

- Plant closings. The shutdown of a single employment site, facility or operating unit, that results in a loss of at least 50 full-time employees, during a 30 day period or

- Mass layoffs. A loss of at least 50 full-time employees during a 30-day period at a single employment site, affecting 33 percent or more of the employer's active employees OR a loss of at least 500 employees during a 30-day period.

Is WARN Notice required with a series of smaller layoffs?

It depends on the timing. Employment losses within 90 days will be aggregated and may trigger WARN unless the employer can show that the losses resulted from distinct causes and were not an attempt to evade the statute's requirements.

Are there any defenses to WARN?

WARN provides three defenses to the full 60-day notice obligation: Faltering Company; Unforeseen Business Circumstances; and Natural Disaster.

These defenses are very fact specific and should be addressed with counsel.

Can anyone other than a direct employer be liable under WARN?

Yes, courts have found parent companies and private-equity investors liable under the WARN Act if they are considered a single employer with the employing company. To determine if related entities are single employers, courts generally apply a five-factor test, which is very similar to the test used to determine joint employment for purposes of FLSA liability.

What happens when a business is sold?

Persons who are employed by a company being sold immediately prior to the sale are deemed to become employees of the buying company, immediately after the sale, without an intervening employment loss. Corporate transactions, including asset sales, need to be addressed with counsel to consider the specifics of each situation.

What is required by WARN?

Covered employers must provide 60-day advance notice of a layoff to the affected employees or their representative (eg, union representative), as well as to state and local governments. Notice to individual employees must be written in clear and specific language that contains details about the closing or layoff, including whether it is permanent or temporary, when and where it will happen, and whom to contact within the company for more information. The notices given to the union representative and government entities are similar.

Alternatively, an employer may provide "pay in lieu of notice" by compensating employees for 60 days' wages and benefits (or a pro-rated portion thereof).

What if I fail to WARN?

Employers who fail to WARN, may be required to pay each affected employee back pay and benefits for each day of the violation period (up to 60 days), along with possible civil fines. Damages to each employee may be reduced by any wages paid by the employer over the period of the violation and any voluntary and unconditional payments not legally required. A credit for severance may apply depending how the employer's severance plan is structured.

What if my state has its own law?

Some states, including California and New York, have enacted WARN-like laws with lower thresholds than the federal WARN Act. For example, NY WARN may be triggered by job losses affecting as few as 25 employees, rather than the 50-employee threshold under the federal law. Employers must comply with both the federal WARN Act and any applicable state analog.

For more information

Employers making the difficult decision to close a work site or lay off a large number of employees should take care to review all applicable policies and state and federal laws and should consult with their lawyers. For more information about the WARN Act, state analogs, reductions in force, layoffs or other labor and employment matters, contact your DLA Piper attorney or the authors of this article.